How Does a Business Loan Repayment Work?

Updated on: April 27th, 2021 – Post by: Andres Fernandez

How Small Business Loan Repayment Works

When it’s time to repay your loan, it’s important to repay in a timely manner. It’s also important to know whether your payments are fixed or variable, how often you have to repay, and how repayments are made. We’re going to break down all the details you need to know below.

Understanding the Loan Terms

Applying for a business loan can get tricky and confusing very fast. So start by getting to know your obligations before signing for a business loan. You should know what your loan term is, your repayment due dates, whether interest is fixed or variable, payoff amounts, prepayment fees, and other aspects of your business loan. Make sure if there is any confusion about the information stated above to contact your lender for further explanation!

If you received a different type or financing, such as a business line of credit, merchant cash advance, or a Small Business Administration loan, your repayment plan may vary.

When You Start Repaying

Majority of the time, you’ll be expected to start repaying your business loan immediately. It all depends on how often you’re suppose to make a payment. This can vary from a daily schedule, weekly or month schedule of your loan. If you have monthly payments, your payment cycle will probably start around 30 days from when you receive your funds.

Although there are exceptions, for example lines of credit may not expect repayment until after the drawn window has closed. Other loan options may offer a period in which payment is deferred. For example, the SBA may defer payments on outstanding loans during an economic disaster like the one caused by COVID-19.

Set up Autopay or Choose a Payment

Many loan providers and lenders allow their customers to set up an automatic payment system that best suits the business. At the end of the day, lenders just want their money back with interest. This way, you will not have to worry about when you have to make a payment or forgetting you even had one ( I hope you don’t).

Another common option that could work for your repayment schedule is the option to choose a day to make all your payments at once. For example, if you have the loan payment and other bills due around the same time, you can choose a specific day for your loan repayment so all expenses could be paid.

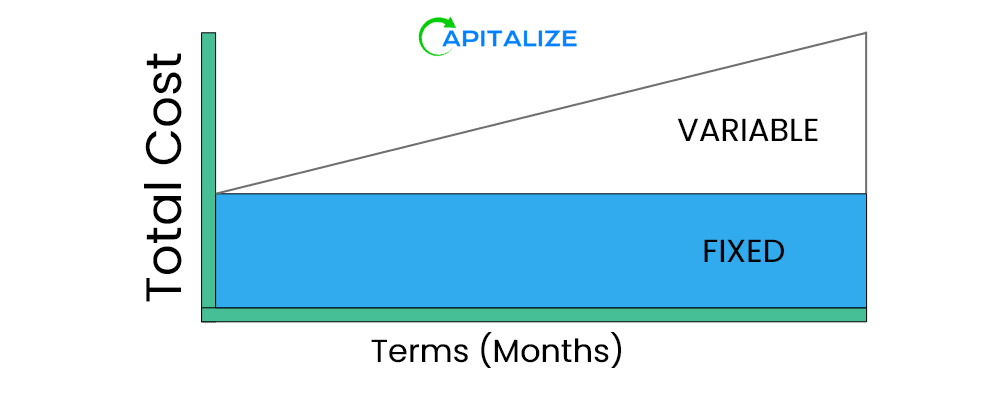

Fixed vs. Variable Payments

Fixed Payment

Businesses or borrowers with a fixed repayment schedule pay the same amount every time they make a payment. For example, let’s say your business took out a merchant cash advance for 16 months. The borrower will have to pay back a fixed amount plus interest every month until the 16 months are fully repaid. The borrower will never pay more or less of the fixed payment.

Variable Payment

A variable payment mean that the amount you’re paying may change. You may have a variable repayment schedule for one of two reasons:

- You have a loan or an advance that is repaid by deducting a percentage of your cash flow. For example, your lender might deduct 15% of each sale until the debt is repaid. These loans do not have a maturity date, because repayment is dependent upon your cash flow.

- Your interest rate is dependent upon your prime rate. If the prime rate goes up, so will your interest rate and consequently your payments. Naturally, if the interest rate drops, your interest rate and payments will as well. The prime rate is generally utilized by lenders who offer loans with long term lengths, or those that offer lines of credit.

Lender's Late Payment Policy

Lenders understand that, from time to time, problems may arise; many have a late payment policy for that reason. Some lenders offer a short grace period, in which no fees will be charged and nothing will be reported to the credit agency. Others give you a chance and allow you to miss a certain amount of payments, which will then be added to the end of your repayment schedule.

Honesty & Communication With Your Lender

It’s important when you’re paying off any type of business loan, to be open with your lender. They don’t like to be left in the dark. Mostly if your payments start to become irregular or you stop paying, they’ll eventually assume you’ve defaulted.

Be transparent with your lender, and let them know what you’re going through, because they’ll be more likely to trust that you’re a responsible lender. Often times, lenders are willing to work out an alternative payment schedule, but honesty is the best policy!

Cut Costs & Reduce Expenses

If you’re a business under debt or operating at a profit and loss relationship, it is always a sensible option to look at your functioning costs. You need to identify and prioritize those areas that are central to your business and relate to your core competencies.

What To Do If You Can't Repay

Unfortunately, you can’t see every possible pitfall coming your way, so it’s important to the your risk in taking out the loan. So let’s say a huge pandemic outbreak happens, which then will create a lockdown so that means your business has to close down. And you’re in danger of not being able to repay the loan because no sales are coming in. There’s actually a lot of options you can do when you’re in danger of defaulting.

From refinancing to negotiating with your lender, there are multiple options. The important thing is that you should be proactive and make an attempt to resolve the situation.

Consider refinancing your debt if your interest is too high, it could be possible to reduce them by refinancing your loan. There are two big reasons for refinancing:

- Your business has grown and you now have access to larger loans at lower costs. This is often referred to as “graduating” to better debt.

- You are struggling to repay your debts, so you need a loan with longer term lengths, smaller monthly payments, or less expensive interest rates and fees.

Tax Deductible: Business Loan Payments

All in all, business loan payments are not tax deductible. When a business loan is received by the borrower, it’s not included as taxable income. Although, when that loan is repaid, you are not able to deduct loan principal payments. You are simply paying back money you borrowed, not income spent.

That doesn’t mean that there aren’t deductions you can still make. Interest paid or accrued on your business loan are tax deductible in most cases.

Keep in mind you must prove that you’re legally liable for the debt and have proof of repayment in order to deduct your loan interest. You also need to show that you have a true debtor-creditor relationship with the lender. The loan funds must also be spent on business expenses, not just kept in a bank account, to be eligible for interest deductions.

Conclusion: Understand the Business Loan Repayment Process

A small business loan could help you grow your business. When taking out a loan, you must make repaying it a priority. If you manage your finances responsibly and make payments on-time, your business loan experience will be a success.