Set Your Financial Goals For 2021

Written by: Andres Fernandez

January 12, 2021

“Forget the failures. Keep the lessons.”

With the new year underway, many resolutions and goals have been made, but have those goals specific enough. For example, many want to save money or better their credit for this year. How are you going to do that? It’s easy to say I want to save enough to buy a trip to Miami, but how much do you need to save weekly or monthly? What is the total amount you want to save and how are you willing to do that?

To accomplish any financial goals for 2021, you need to prioritize the steps it takes to crush them. Setting your goals is one thing, but transforming them into reality is another thing.

Why Should You Set Financial Goals?

In 2021, it’s critical to set financial goals because they serve as a guide for how you manage your money. Your goal is to save money and stay committed to doing it, don’t waste money on things you don’t need. Trust me, you really didn’t need that new iPhone. This drives a positive behavior change and will be the foundation for a great 2021. We have listed 7 doable financial goals for 2021 that will help you and your business succeed, along with tips on how to keep them.

How To Achieve Your Financial Goals For 2021

After you’ve decided and developed your goals, it’s time to do the work to achieve them. This is the step where many people fail. Let’s take a look at the steps you need to take to accomplish your financial goals for 2021.

- Write Them Down – According to a study conducted by Mark Murphy, the neuroscientist explains why writing goals down is the proper way to begin achieving them. (It’s a great read!) Studies have shown that goals that are written down should be visualized in your mind, and are far more likely to be accomplished than those that are not. Take the time to write and visualize your goals, even create a vision board for your room, home office, work office, or even in the living room to see it everyday. Keeping them at the forefront of your mind will constantly remind you to work towards them.

- Break down your goals into short, medium, and long term goals. (Scroll down and check out financial goal number 4.)

- Track Your Progress – Some goals take longer than others, so it’s vital to see and keep track of your progress to stay motivated or even to congratulate yourself of how far you’ve gotten to keep going.

- Stay Accountable of Yourself! – Having someone’s support is nice and motivating, but keeping track of yourself and staying accountable is important. Stay on top of yourself and make sure what you are doing right now is worth for the goals that you have set in place.

1. Refinance Your Loans

With the coronavirus pandemic having impacted many parts of life this past year, it has recorded low interest rates, making this a prime time to refinance and lower your monthly payments. If you’re able to secure a better rate and more favorable terms, refinancing your business loan could save your money in the long run.

Lowering your loan payments and setting up better repayment dates would free up cash flow within your business. This will give you the opportunity to invest the extra funds in payroll, equipment, inventory or other aspects of the business.

In addition, if a loan refinance would positively impact your cash flow, a lender like ours could approve you for a larger loan amount based on your debt-service ratio, which measures whether you have enough cash to cover your debt. Getting approved for a larger loan amount could save you from taking out a second loan if you need additional funding for your business.

2. Pay off Credit Card Debt

Having credit card debt gets to be really stressful if not paid on time. Consider making it a goal for 2021 to pay if off. These are two of the most common yet effective strategies to lower your credit card debt and better your FICO score.

- The Debt Avalanche Method: Pay off your highest debt first

- The Debt Snowball Method: Pay off your smallest amount of debt first

Bonus

- Pay off the debt with the highest interest rate. Make the minimum payment or even a little more than the minimum to boost your credit score.

3. Automate Your Savings For Emergencies

Saving for emergencies should be at the top of your financial goals for 2021 list. Having money set aside for unexpected expenses helps protect you from a financial crisis. The emergency fund should not only cover emergencies but expenses as well. Many business industries have seasonals where sales is at its lowest and highest, so knowing these trends and having the funds to protect yourself is life saving.

One of the easiest ways to build your savings is to automate your funds. Most employers allow you to divide your paycheck into different accounts. If not, you can likely set up automatic transfers with your bank.

Most financial experts recommend that you have the equivalent of at least 3-6 months worth of expenses in a savings account for emergencies. If this seems overwhelming, you begin by adding $200-500 a month until you are able to add more while still paying off your credit card debt or loans.

Having any amount set aside to help is better than nothing.

4. Short, Mid or Long Term Goal

Any set of goals must have an “expiration date.” When do you want it and how realistically is it to achieve this goal?

There is a relationship between long term and short term goals. Often, achieving a long-term goal requires reaching a set of short-term goals.

For example, in order to buy a $960 mountain bike in four years (long-term), you will need to save $240 (medium-term) in each of the next four years, or $20 a month (short-term). Also, consider what you are going to do to achieve the $20 a month and so on. Have a definitive plan to stick to it!

Breaking long-term goals into medium- and short-term goals helps to make them seem achievable.

5. Boost Retirement Savings

People really do not understand the importance of saving for retirement. I know you might be light-years away or right around the corner; why does it matter, i’m doing good now, why not later, right? NO!

Use 2021 to boost your contributions to your 401(k)s or HSAs, plan a comprehensive retirement goal, no matter your age or life stage. Take meaningful steps to boost your financial wellness. If your employer offers a 401(k) match, be sure you’re contributing enough to get the full match since it’s essentially free money. Also make sure you are aware of where your money is being invested in.

6. INVEST INVEST and INVEST MORE!

This is by far what I believe is the most important contribution your money should be going to. (Of course your credit card debt, but remember there’s a balance.)

Do not limit investing to retirement contributions. If you already have an emergency savings account, consider setting up another account to invest.

You’ve probably heard of the magic of compound interest. The best way is to see it for yourself.

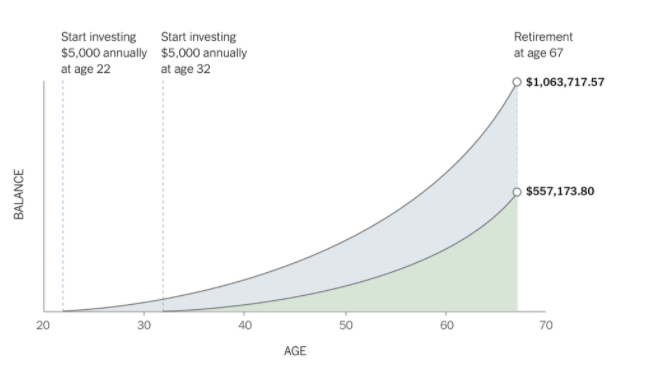

If two people put the same amount of money away from each other ($5,000), earn the same return on their investments (6% annually) and stop saving upon retirement at the same age (67), one will end up with nearly twice as much money just by starting at 22 instead of 32. To put it another way: The investor who started savings 10 years earlier would have about $500,000 more at retirement.

Saving should be turned into a habit, just like it’s a habit to go out to eat every weekend to your favorite steak spot. It may make rational, mathematical sense to start saving as early as possible, but it isn’t always easy. But the instinct to save grows as you do it. It’ll begin to feel good as you see the balance on your account starts to grow.

7. Diversify Your Income

Building multiple streams of income is no longer a luxury, it has become a necessity. If the high rate of unemployment throughout this last year and mounting job losses have taught us anything, it is that nobody’s job is safe. Unfortunately for most people, their only source of income is from their job, which can be a risky way to live. Some couples may be more fortunate and have a spouse bringing in money each month, yet still relying on their only source of income.

Each item listed below is an example of how alternative income sources can be used to lesson the risk of living on a single income.

- Rising Health Care Costs – Regardless of whether you are supportive of health care reform or not, odds are you are feeling the spot of higher medical care costs. Adding an additional source of income can go far in paying for things like higher prescription costs and sudden clinical expenses.

- Living Within Your Means – In order to build true wealth, you must be able to live within your means. If it is impossible to cut your spending any further, or you don’t want to sacrifice anymore – create a new source of money. There are only two ways to live within your means — either spend less or make more money.

- Pay Cash for Purchases – How many times have you been able to pay cash for a car or could pay for a large home improvement project without taking out a loan? A second or third income stream could be used to save for these types of purchases so you don’t have to take out a loan and pay any interest. What a concept—pay less interest and keep more of your money!

- Build a New Income Stream – What better way to use your extra income then using it to grow another income stream? If you don’t need it to survive, then why not use your extra income to your advantage to increase your monthly cash flow and become financially independent?

Final Thought on Your 2021 Financial Goals

Money drives almost all aspects of life. Getting in control of your financials is one of the most important things that you can do for yourself or your business. The first step is write down the goals you need to do to achieve the grand goal.

I hope you were able to gain some ideas and fundamental steps to get you started on the right track. Do not forget to check out our other resources we have.

Flexible Funding

You make decision when and how much you want to use your funds. As long as you have funds available, you can withdraw at anytime.

Fast Access

Withdraw from your line of credit whenever you want, as long there are funds available. You'll have the security to use whatever you need, wherever you are.

Trusted by Thousands

Capitalize customers have securely been funded over $3,000,000 directly to their bank account. Our application form, is highly secured so no information is hacked.

Flexible Terms

Capitalize Loans™ loans have simple terms ranging from daily, weekly, and monthly. No upfront fees or prepayment penalties. We provide you with a payment schedule before taking a loan so there won't be any surprises.

Simple Process

Securely link your last 3 month of bank statements to automatically get reviewed. This allows underwriters to evaluate your business right away and get approved fast.

Personal Service

Our team of experts are here to help when you need it, around the clock. We offer many ways to get in contact with us: phone call, email, text, and chat box is the fastest way to get ahold of us.