Small Business Loan Solutions

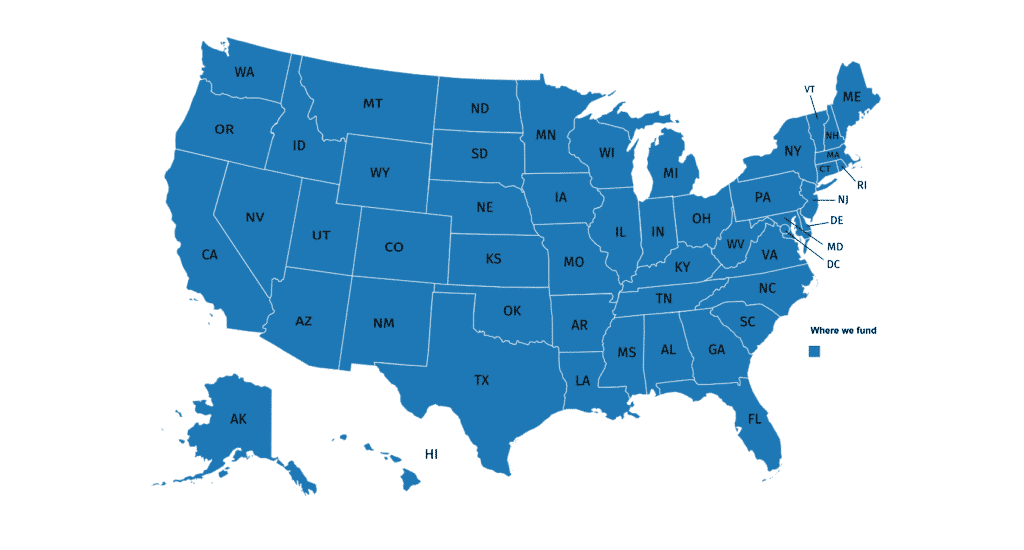

Start Capitalizing Your Business No Matter What Part of The Country!

There are many different business loan types for small businesses, making it essential to do your research before beginning any application process. The best place to start is by identifying what your specific use will be for the loan. If your objective for the money isn’t clear, it’s safe to say you have work to do before knocking on a lender’s door.

You got what it takes to grow

Available Business Loan Types

The flexibility and safety net your business needs. No obligation to use it, only when it's necessary.

Borrow against future business earnings to access capital today! Like time travel, or close to it.

The classic because it's tried and true. A stable, flexible way to get more working capital to grow your business

Borrow against future business earnings to access capital today! Like time travel, or close to it.

Finance the tools you need, from software to tractors.

An advance on your accounts receivable. Have unpaid invoices? Gain access by selling your purchase orders or receivables.

Learn about our Business Loan Types

Business Line of Credit

Having access to cash is very important to business owners. Having a little extra cash now and then is a flexible way to stay on top of your finances. Only take out what you need and pay back only what you used.

SBA Loan

The Small Business Administration has extended all disaster relief application until December 31st, 2021. They are offered by lenders and backed by the U.S. Small Business Administration.

Capitalize has several different SBA loan options, from the SBA 7a, SBA 504, and SBA Express loans.

Term Loan

Capitalize offers business term loans to established businesses who are in need to cover unexpected costs and improve your business credit score.

Business Advance

A merchant cash advance (MCA) is used to borrow against future earnings to have faster access to capital within 24 hours. Easy to qualify for and does not require collateral or equity in your business.

Equipment Financing

Need a new truck, CRM, or kitchen appliances? We help you finance all equipment you need to grow your business. We know the tools you are looking for will grow your business, but do you? Apply Now.

Invoice Factoring

Use your unpaid invoices to your advantage. If you are still waiting for your invoices to be paid, but need the money right away then invoice factoring is the best solution. Send over your outstanding invoices, or accounts receivable today.

LET’S GET STARTED

Apply for Small Business Capital

After filling out our single application, you’ll get to speak to one of our dedicated advisors to take the time to get to know your business and help you understand your small business funding and repayment options.